The 45-Second Trick For Dental Debt Collection

Wiki Article

Some Known Facts About Dental Debt Collection.

Table of ContentsInternational Debt Collection Things To Know Before You BuyThe Only Guide to Dental Debt CollectionSome Known Factual Statements About Debt Collection Agency All About International Debt Collection

A debt collector is an individual or organization that is in the service of recuperating money owed on delinquent accounts. Several financial debt collectors are employed by firms to which money is owed by people, operating for a level fee or for a portion of the quantity they are able to gather.

A financial debt enthusiast tries to recoup past-due debts owed to creditors. Some financial obligation enthusiasts purchase overdue financial debts from financial institutions at a discount rate and also then seek to accumulate on their very own.

Debt collectors who violate the regulations can be filed a claim against. When a debtor defaults on a debt (meaning that they have actually fallen short to make one or more necessary settlements), the loan provider or lender might turn their account over to a financial obligation enthusiast or debt collectors. Then the debt is said to have actually mosted likely to collections (International Debt Collection).

Some companies have their own debt collection divisions. Most discover it much easier to work with a financial debt collector to go after overdue debts than to chase after the clients themselves.

Getting My International Debt Collection To Work

Debt collection agencies might call the person's personal and also job phones, as well as also turn up on their doorstep. They may also contact their family, friends, as well as neighbors in order to confirm the call details that they have on declare the individual. (Nevertheless, they are not enabled to disclose the factor they are trying to reach them.) In addition, they might mail the borrower late repayment notices.m. or after 9 p. m. Neither can they falsely assert that a debtor will certainly be apprehended if they stop working to pay. In addition, a collector can't literally harm or endanger a borrower and also isn't allowed to take assets without the authorization of a court. The law additionally offers debtors particular rights.

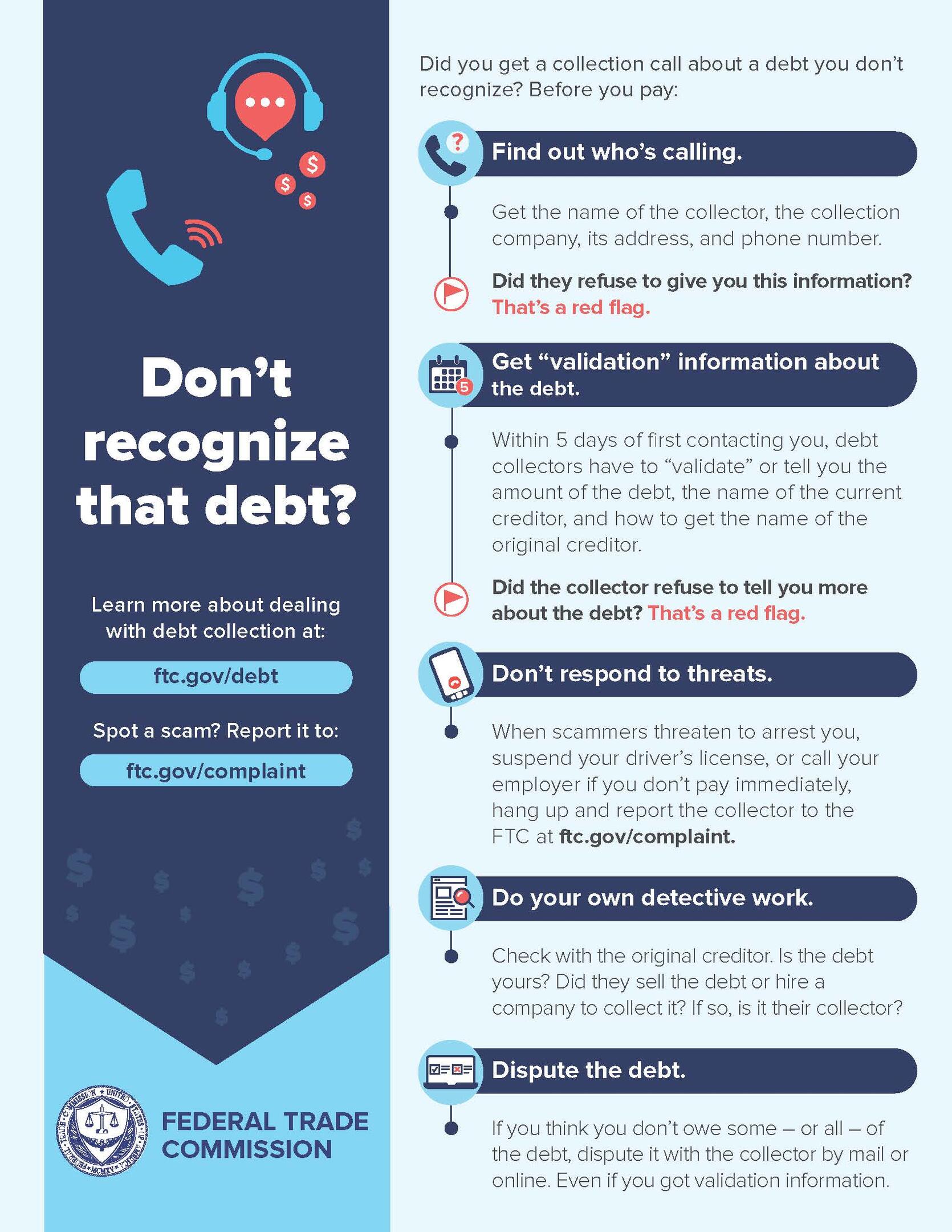

People who think a financial obligation collector has damaged the regulation can report them to the FTC, the CFPB, and also their state chief law officer's office. They additionally can file a claim against the debt enthusiast in state or government court. Yes, a financial obligation enthusiast might report a financial debt to the credit score bureaus, yet just after it has gotten in touch with the borrower concerning it.

Both can continue to be on credit history records for as much as seven years as well as have check out this site a negative effect on the individual's credit rating, a large portion of which is based upon their payment history. No, the Fair Debt Collection Practices Act uses only to consumer financial obligations, such as home loans, bank card, automobile fundings, student car loans, as well as medical bills.

Dental Debt Collection Fundamentals Explained

Because scams are typical, taxpayers ought to be careful of anybody purporting to be working on behalf of the Internal revenue service as well as examine with the Internal revenue service to make certain. Some states have licensing needs for financial obligation enthusiasts, while others do not.Financial obligation collectors supply a helpful solution to lenders as well as other financial institutions that wish to recoup all or part of cash that is owed to them. At the very same time, the law provides specific consumer protections to maintain financial obligation enthusiasts from coming to be also hostile or abusive.

The CFPB's financial debt collection policy calls for financial obligation collectors. International Debt Collection to give you with certain details regarding your financial obligation, referred to as recognition information. Generally, this information is supplied in a composed notice sent as the initial communication to you or within 5 days of their first communication with you, and it may be sent out by mail or digitally.

This notification usually should consist Recommended Site of: A statement that the communication is from a debt collection agency, Your name and also mailing information, together with the name and mailing information of the debt collection agency, The name of the financial institution you owe the financial debt to, It is possible that greater than one creditor will be detailed, The account number connected with the financial obligation (if any)A breakdown of the present amount of the debt that mirrors rate of interest, fees, settlements, and credit reports considering that a particular date, The current quantity of the financial debt when the notice is supplied, Info you can make use of to respond to the debt collection agency, such as if you believe the financial obligation is not your own or if the quantity is wrong, An end date for a 30-day period when you can contest the debt, You may see various other details on your notice, however the details noted over typically must be consisted of.

More About Business Debt Collection

Find out more about your debt collection defenses..

Claim, you don't pay a credit history card expense for one or more billing cycles. see here An agent of that card provider's collection division might connect to request repayment. When a financial obligation goes overdue for a number of months, the initial creditor will certainly typically offer it to an outside agency. The buyer is called a third-party debt enthusiast."Debt collection agency" is another term used to explain third-party financial debt collectors.

:max_bytes(150000):strip_icc()/how-debt-collection-agency-business-works.asp_Final-d52ff61e187e4113879e73bb782bbc5e.jpg)

The FDCPA legitimately identifies what debt collectors can as well as can't do. For instance, they need to inform you the amount of the debt owed, share details about your civil liberties and clarify exactly how to challenge the debt. They can likewise sue you for settlement on a financial debt as long as the statute of limitations on it hasn't run out.

Report this wiki page